Financing the Energy Revolution

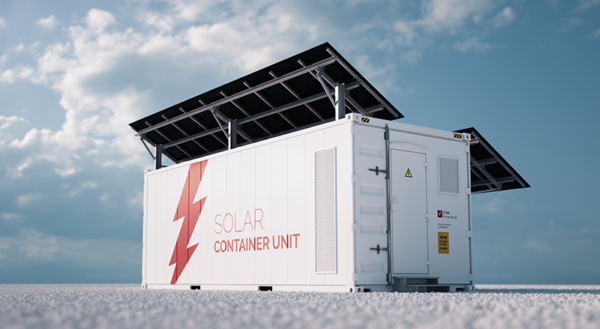

ClearGen understands the challenges distributed energy resource developers face in delivering new behind-the-meter resources in complex and dynamic markets. We work with them to take the mystery out of project financing and structuring so that they can turn concepts into action. We bring capital to projects that deliver the results end users demand while helping to make the world a cleaner place.

ClearGen is managed by industry veterans with years of energy experience and backed by a long-term capital commitment from Blackstone, a leading global investment business, through its credit division arm. Together with Blackstone, ClearGen serves as a one-stop-shop for clean energy capital needs.

On-site energy will double in the US and renewables will grow faster than any other form of energy through 2050, according to the most recent Annual Energy Outlook (AEO) by the US Energy Information Administration (EIA).

While some entities pursue ESG goals through the purchase of RECs or participation in Virtual Power Purchase Agreements (VPPAs), facility owners that operate on-site renewable energy and microgrids contribute to immediate and lasting reduction in Scope 2 carbon emissions.

Investment Tax Credits and state and wholesale market incentive programs can pay for as much as 35% of US-based projects funded by ClearGen. We work with our development partners to make incentives as bankable as possible to reduce customer costs and improve their returns.

Distributed energy projects can dramatically improve the reliability of operations for facilities where the impact of energy supply outages is critical. For many of these entities – hospitals, manufacturers, cold storage warehouse, and others – the value created by redundant energy resiliency is the most important factor in their adoption of distributed energy systems.

Businesses are at last capable of attaining cleaner, cheaper and more reliable energy thanks to technological and market innovations. ClearGen helps our development partners and customers answer the final question: Who brings the money?

Rob Howard

Chief Executive Officer

Team